Ira contribution calculator fidelity

Heres more on the pros and cons of the IRA vs. In 2022 SEP IRA contributions are capped at 61000 or 25 of your eligible compensation whichever is lower.

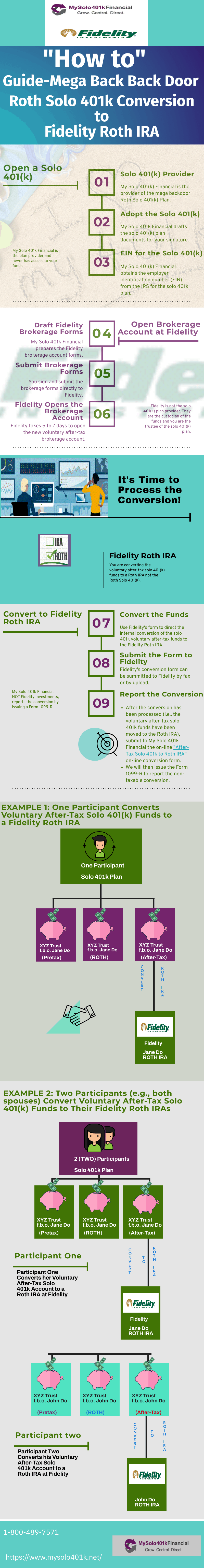

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Fidelity Retirement Score and Retirement Income Calculator regarding the likelihood of various investment outcomes are hypothetical in nature do not reflect actual investment results and are not guarantees of future results.

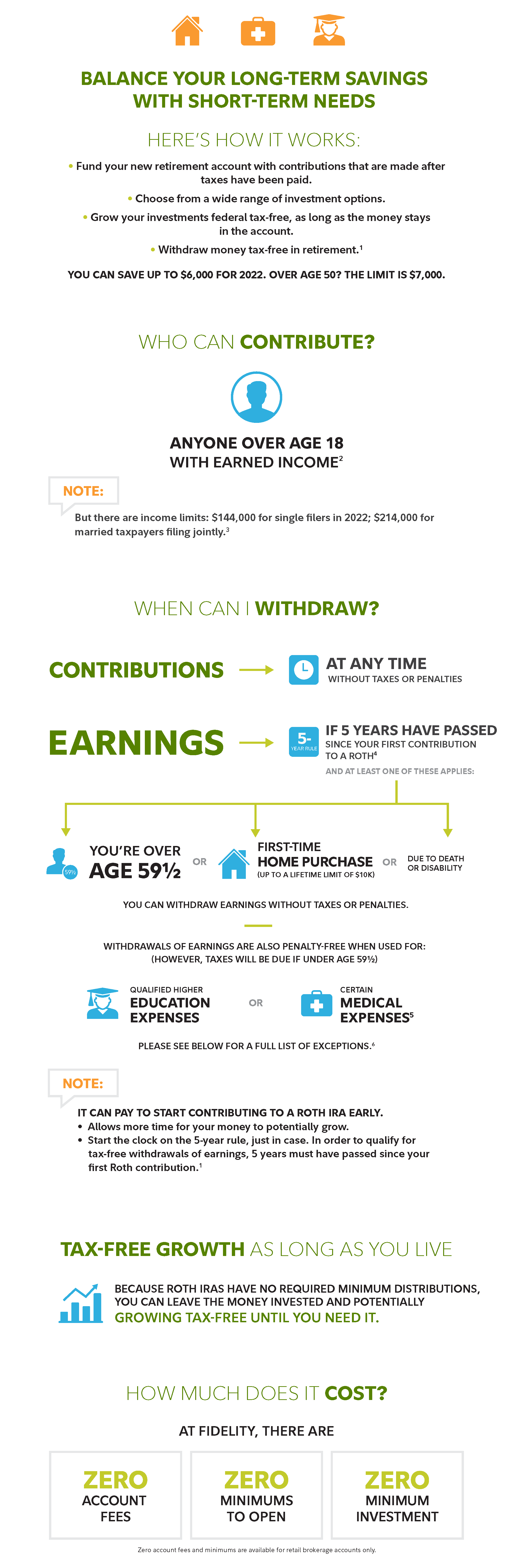

. Earnings from a Roth IRA can be withdrawn federally tax-free and penalty-free provided that its been 5 years since your first contribution. You can generally contribute up to 6000 or 7000 per year to a Roth IRA contribution limits vary by income and age and may change each tax year. Heres how to choose between a Roth IRA and a Traditional IRA Jump ahead for more tips on choosing between an IRA and a 401k.

You can use the Contribution Worksheet PDF to calculate your annual contributions. Determine your estimated required minimum distribution from an Inherited IRA. Fidelity reports SEP IRA contributions on IRS Form 5498 in the year they are made which may not be the deduction year.

The rules vary depending on the type of IRA you have. A hardship withdrawal allows the owner of a 401k plan or a similar retirement plan such as a 403b to withdraw money from the account to meet a dire financial need. Heres how a Roth IRA works who qualifies and FAQs.

From tax advantages maximum contribution and fees here are some details that can convince you to consider a Roth IRA. Partial contributions are allowed for certain income ranges. Traditional IRA contributions are not limited by annual income.

Fidelity Investments PO Box 770001 Cincinnati OH 45277-0003. The concept behind Roth IRA is that you make contributions to this account with after-tax moneyOnce you turn 59½ and have been in a Roth IRA plan for five years all distributions taken from the plan are tax-free. Converting to a Roth IRA may ultimately help you save money on income taxes.

If you have ever made a non tax-deductible contribution to any non-Roth IRA or if you have inherited and treat as your own a non-Roth IRA from a. A Roth IRA is a retirement account in which after-tax money grows tax-free and withdrawals are tax-free. Roth IRA Conversion Calculator.

Contribute to your account. Roth IRA contribution limits and eligibility are based on your modified adjusted gross income MAGI depending on tax-filing status. Once you have established your Self-Employed 401k Plan and any new accounts the next step is to contribute to your 401k.

Fidelity Brokerage Services LLC Member NYSE SIPC 900 Salem Street Smithfield RI 02917. It is the employers responsibility to claim the deduction for the appropriate tax year. For example lets say youve previously made 94000 in pre-tax contributions to a traditional IRA and make a non-deductible IRA contribution of 6000 this year with the intention of.

The amount you as the employer can put in varies based on your earned income. Maxing out your annual Roth IRA contributions is one of the best ways to impact your retirement savings. Under certain conditions you can withdraw money from your IRA without penalty.

The SEP IRA is similar to a traditional IRA where contributions may be tax-deductiblebut the SEP IRA has a much higher contribution limit. 2 Starting at age 59½ you can begin taking money out of your IRA without penalty but. You will pay taxes on your earnings and contributions when you make withdrawals.

A common misconception is that the reporting should mirror the contribution year reporting for traditional and Roth IRAs. To better understand your eligibility use our IRA Contribution Calculator. Generally for a Traditional IRA distributions prior to age 59½ are subject to a 10 penalty in addition to federal and state taxes unless an exception applies.

Traditional IRA calculator. IRA investors will find a lot to love at Fidelity InvestmentsThe firms online brokerage platform offers a strong lineup of no-minimum-purchase mutual funds four zero expense ratio index funds. To mail contributions to Fidelity.

A Roth IRA offers many benefits to retirement savers. They can contribute to a custodial Roth IRA. Keep in mind though that you can only transfer in up to your total HSA contribution limit for the year meaning your IRA rollover is less a rollover and more making your HSA contribution for.

Charles Schwab offers a wide range of investment advice products services including brokerage retirement accounts ETFs online trading more. Find out which IRA may be right for you and how much you can contribute. If you overcontribute to your Roth IRA you can run into penalty taxes.

The Roth IRA allows workers to contribute to a tax-advantaged account let the money grow tax-free and never pay taxes again on withdrawals. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. Roth Conversion Calculator Methodology General Context.

Including Fidelity and Charles Schwab. Roth IRA calculator.

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Fidelity Roth Ira Accounts For The Average Joe 2021 Youtube

Contributing To Your Ira Start Early Know Your Limits Fidelity

What Is The Best Roth Ira Calculator District Capital Management

How To Protect Your Retirement Savings Fidelity Investments Investing Investment Portfolio Saving For Retirement

2

Save For The Future With A Roth Ira Fidelity

They Include Social Security And Give A Score Out Of 100 Learn Just How Prepared For Retirement Yo Preparing For Retirement Fidelity Retirement Retirement

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

How To Invest Your Ira Fidelity Investing Investment Portfolio Saving For Retirement

Roth Ira Conversion Calculator Is A Roth Ira Right For You Calculators By Calcxml Roth Ira Conversion Roth Ira Conversion Calculator

Roth Conversion Calculator Fidelity Investments

Financial Calculators Tools Fidelity

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Investing Investing Money Roth Ira

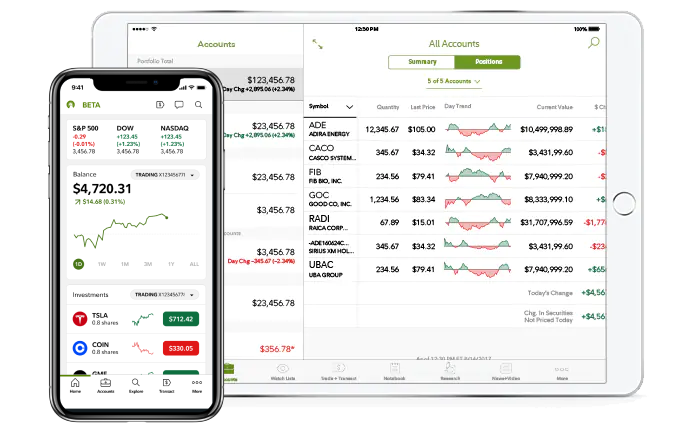

Mobile Finance Fidelity

After Tax 401 K Contributions Retirement Benefits Fidelity

Fidelity Go Review Smartasset Com